Did you know that your daily spending habits could be the difference between securing your loan… or not?

The big news in the finance world in the past 12 months (outside of the cash rate and whether or not it will increase and by how much) was the focus of tighter lending criteria.

Several years ago, the Australian Prudential Regulation Authority (APRA) introduced regulation for the accuracy and verification of borrower income and spending information in support of loan applications. Now with open banking and moving towards a cashless society,

Lender focus

The focus on lenders’ assessments of borrower living expenses and total debt is aimed at ensuring a more realistic assessment of a borrower’s genuine capacity to repay their home or investment loan.

Why is this important?

Encouraged by historically low interest rates during

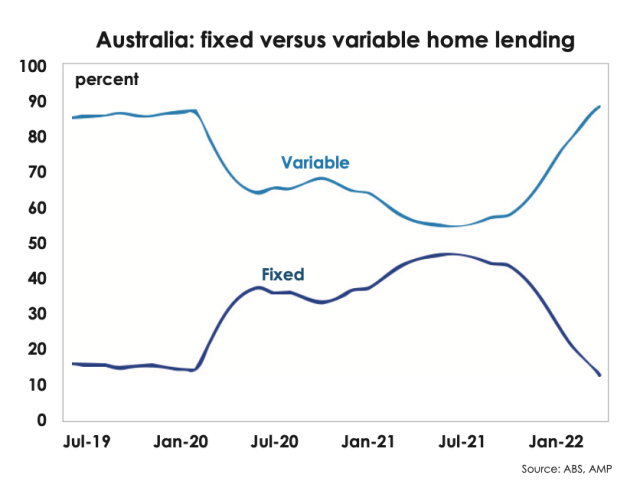

the pandemic, over 40% of borrowers fixed into very good low interest rates. As you can see from the chart, previously fixed lending was typically 10-15% of the total mortgage market.

Many of those on fixed interest loans will roll off in the second half of 2023, leaving many borrowers scrambling to cope with much higher monthly repayments.

When your fixed term expires, you typically roll into a variable loan and pay the lender’s standard interest rate. That may suit some, however we expect many mortgage holders will want a loan review to find a finance option that may be more suitable than what is on offer with their existing lender.

Serviceability is the key to a new loan

When changing loan products or finance institutions, serviceability may be the top concern. The lender

will scrutinise your spending patterns as part of their assessment in deciding your loan approval or rejection.

Big brother is watching…

Many lenders now have greater visibility over your spending. They can determine things like how many coffees you buy a week, how often and how much you spend on groceries, alcohol, grooming and clothes.

Have you noticed in your lending app and statements that your transactions on your online statements are grouped into categories such as groceries, utilities, cash out, retail spending etc? This is one way of assessing whether you are living within your means or not.

It is also important that you and your partner are on the same page when it comes to managing your finances if you intend to apply for a loan or refinance together.

So… How can WE help?

There can be a variety of reasons a lender may reject a loan application. This is where we can provide assistance to work in your best interest. We help you navigate what is sometimes a complex process to ensure you

are ‘loan application ready’ and have a better chance of loan approval. We will also be honest if we think your application may be rejected.

It is our job to keep up with regulatory changes, interest rates and loan products to help you find a range of suitable home or investment loans for your individual circumstances. An accurate assessment of your situation and home loan readiness will help you move forward with confidence.

We highly recommend you assess your spending, understand how much you spend, and what you can reduce at least three months BEFORE a loan review.

During the holiday season it is really easy to overspend. Be careful and only spend what you can afford.

Article Supplied by Scott Heathwood of https://www.wealthyandwise.com.au

The Tax, Super & Financial Advice One Stop Shop

84 Nicholson Street | Woolloomooloo NSW 2011

t. 1300 226 271 | +61 432 159 424

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced or republished without prior written consent.